capital gains tax increase news

This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the next federal budget. The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million.

The Biden Administration is proposing to nearly double US capital gains taxes to 396 per cent from the current rate of 20 per cent.

. Proposed capital gains tax. Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is. President Biden is expected to announce a proposal to nearly double the capital gains tax rate in order to help fund a forthcoming spending package according to multiple reports.

Capital Gains Tax Rate Update for 2021. Republicans focus tax hike opposition on capital gains change. FAIRA also requested the Centre to bring down the short-term capital gains tax from 30 per cent to 20 per cent and to increase the home loan interest deduction from Rs two lakh to Rs 5 lakh for tax rebate.

Under the proposal the capital gains tax rate would increase from 20 to 25. A capital gains tax increase would be a form of annual wealth tax that would be. Tax base improving tax enforcement and levying new taxes.

Increasing the capital gain inclusion rate may be one tax change the Canadian government could consider in order to boost tax revenues. The White House has proposed a plan that will essentially double the capital gains tax for investors making over 1000000 to fund trillion dollar initiatives like the American Families Plan American Jobs Plan and The Infrastructure Investment Act. Increase in Capital Gains Taxes Will Affect Your Business in Many Ways.

October 3 2021 By Susan Kaplan. The change which is part of his budget. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues. In the latest development the president has proposed raising the top tax rate on capital gains from 20 to 396 on families with income over 1 million. The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA.

This 25 bracket kicks in once a taxpayers income exceeds 501600 for those married filing jointly. Add in the 38 surtax on net investment income and the total tax rate on long term capital gains and qualified dividends would be 288. The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Capital Gains Tax May Increase to 288 With New Democratic Proposal But Keeps Lucrative Wealth Inheritances Off The Table By Renz Soliman Sep 14 2021 0330 AM EDT Democrats proposed to raise the capital gains tax and qualified dividends to a total of 288 on Monday marking one of many tax reforms that officials are discussing to target rich. The underlying tax proposal is a hike in the capital gains tax from a top rate currently of 238 percent to 434 percent which is set to.

Capital gains tax. While it technically takes effect at the start of. S proposed tax increases are increasingly focusing their opposition on one floated change to.

Capital gains tax rates on most assets held for. Capital gains tax The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. On the impact of Goods and Services Tax FAIRA said GST on cement and steel is 28 and 18 per cent respectively and the tax outgo has spiked.

In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. The capital gains inclusion rate is by no means a sacred cow and I suspect it is perpetually on the table as a way to increase tax revenue without having.

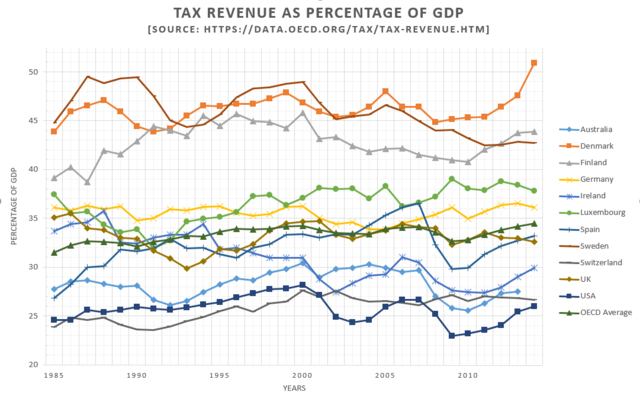

How Do Taxes Affect Income Inequality Tax Policy Center

Cost Inflation Index Meaning Index From 1981 1982 To 2020 21

Options Trading Taxes For All Traders Option Trading Futures Contract Capital Gains Tax

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Be Prepared For A Hike In The Property Tax In Nagpur Next Year Capital Gains Tax Green Cards Nagpur

Capital Gains Accounting Education Bookkeeping And Accounting Accounting And Finance

Capital Gains Definition 2021 Tax Rates And Examples

Indexation Meaning Benefits And Calculation Scripbox

Cost Inflation Index Fy 2021 22 Capital Gain Taxation Ay 2022 23

How Do Taxes Affect Income Inequality Tax Policy Center

Tax On Property Transaction Below Circle Rate Sec 50c Sec 56

What S In Biden S Capital Gains Tax Plan Smartasset

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under The C Capital Gains Tax Capital Gain Paying Taxes

/business-office-entrepreneur-professional-551db58768a445298e0760a6c2e7184e.jpg)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)